|

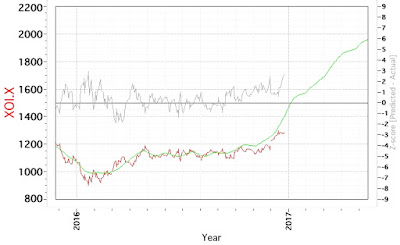

| 2017.07.21 Gold Cycle Model Chart |

The gold cycle model predictive curve continues to shift to the right, suggesting a continued basing process for the actual price going forwards. What is quite remarkable is that the Z-score is now in record territory for positive Z-scores, but still just below the absolute value record of the Z-score which occurred in 1980.01.21 which was resolved in a few days. In other words, the actual price caught up with the predicted price. That said, it is also possible this model is useless at this time. My GDXJ model is still in buy mode as of 2017.07.21, and I still have to execute the run for GLD which I will post

here at the end of the weekend. In the shorter term, the neural models are much more accurate. One enhancing factor is that they also have inputs for volume related transformations. The previous model run is shown below and

here on the blog.

|

| 2017.05.26 Gold Cycle Model Chart |